Forecasts & Results

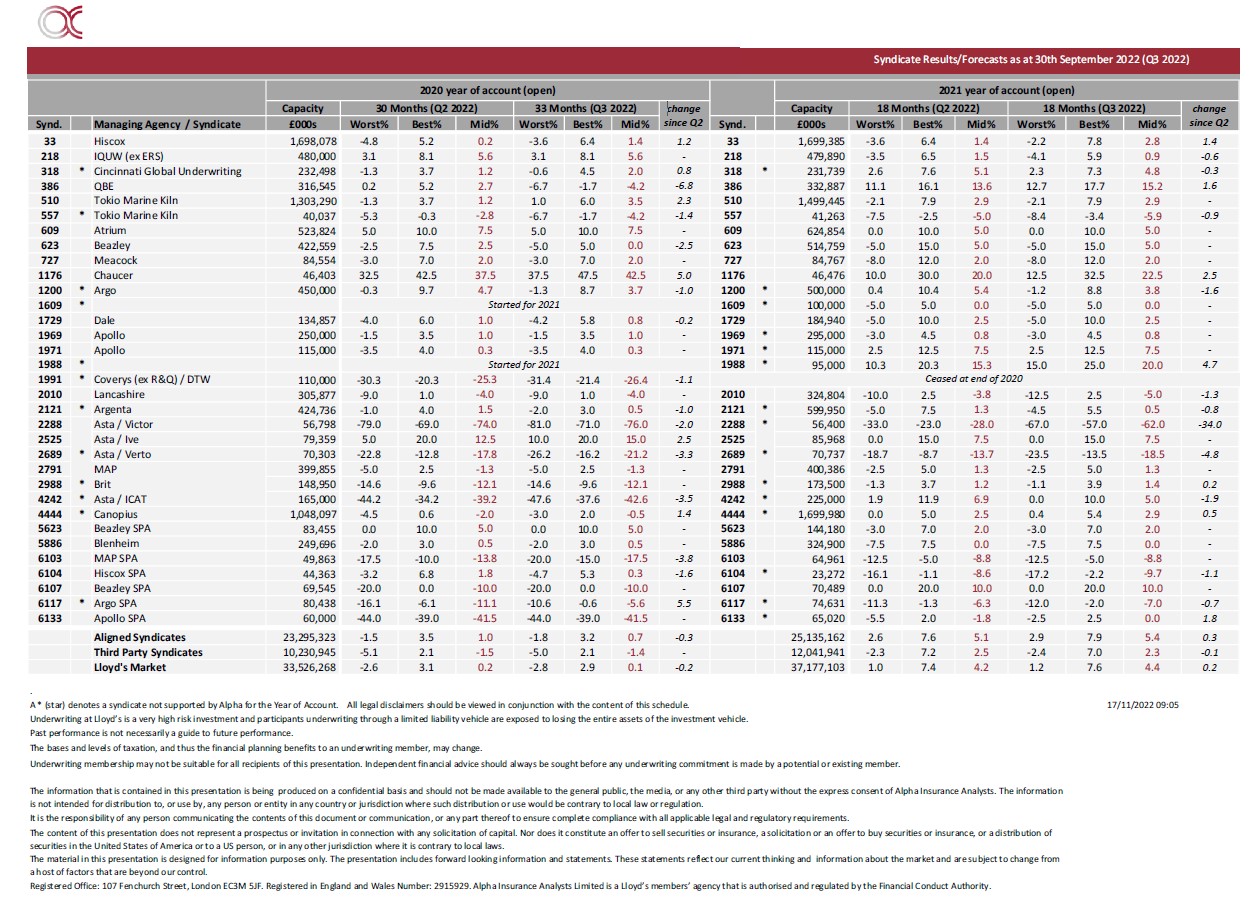

Full Schedule of Syndicate Forecasts as at 30th September 2022

Posted 17/11/2022 – Forecasts & Results

Please see below the full schedule of the latest 2020 and 2021 year of account forecasts as at 30th September 2022. Please click here to download a PDF of the schedule.

2020 Year of Account

The latest forecast for the Lloyd’s market for 2020 is a midpoint profit of +0.1% (within the range -2.8% to +2.9%). This is a slight reduction from the midpoint profit of +0.2% forecast last quarter. Aligned syndicates are forecasting a midpoint profit of +0.7%, a deterioration of 0.3 percentage points (the same deterioration seen in Q2) whereas syndicates with third party capital are forecasting an aggregate loss of -1.4%, (a 0.1 percentage point improvement from last quarter). The 2020 forecast for the average Alpha portfolio has stayed pretty level at a midpoint profit of +2.2% from +2.1%. We calculate that the average private member is forecasting a loss of -0.2%, and, therefore, Alpha looks to be outperforming the market by 2.1 points and our peers by 2.4 points, with the gap continuing to widen each quarter. This improvement in our average forecast is despite the issues faced by our syndicates from their investment portfolios.

2021 Year of Account

The latest market forecast for the 2021 year of account has slightly improved to a midpoint profit of +4.4% (within the range +1.2% to +7.6%) from +4.2%. This is the first year since 2015, when both the top and bottom ends of the range for the market forecast result at this stage are positive (and have both increased this quarter). Syndicates with aligned capital are reporting a midpoint forecast profit of +5.4% (a 0.3 percentage point improvement), whereas syndicates with third party capital are forecasting a slightly reduced aggregate midpoint profit of +2.3%. The 2021 forecast for the average Alpha portfolio has improved to a midpoint profit of +3.0%, up from +2.8% last quarter. We are pleased to see this forecast steadily improve despite the slight downward trend of the aggregate of third party supported syndicates overall.